Will AI Replace Accountants? What You Need to Know

No, AI isn't going to replace accountants. Not by a long shot.

What it is going to do is become an indispensable partner in the profession. It's built to automate the tedious, repetitive tasks, freeing up accounting professionals to focus on the strategic work that really matters. The question isn't about replacement; it's about evolution.

The Evolution of Accounting in the AI Era

The chatter around AI in accounting often sounds like a doomsday prediction, but the reality is much more about powerful collaboration.

Think of it this way: AI is like the autopilot on a commercial flight. It handles the routine, repetitive parts of the journey—like maintaining a steady altitude and direction—with incredible precision. But this doesn't make the pilot obsolete. It frees them up to focus on the big picture: navigating bad weather, managing complex systems, and making the critical decisions needed for a safe landing.

In the same way, AI is taking over the manual, number-crunching jobs that used to eat up an accountant's day.

Shifting Focus from Calculation to Consultation

Instead of getting bogged down by endless data entry or tedious bank reconciliations, accountants can now step into the role of a strategic navigator for businesses. They can interpret the data that AI processes, spot emerging trends, and offer the critical insights that actually drive growth. It’s a fundamental shift from a reactive, historical focus to a proactive, forward-looking one.

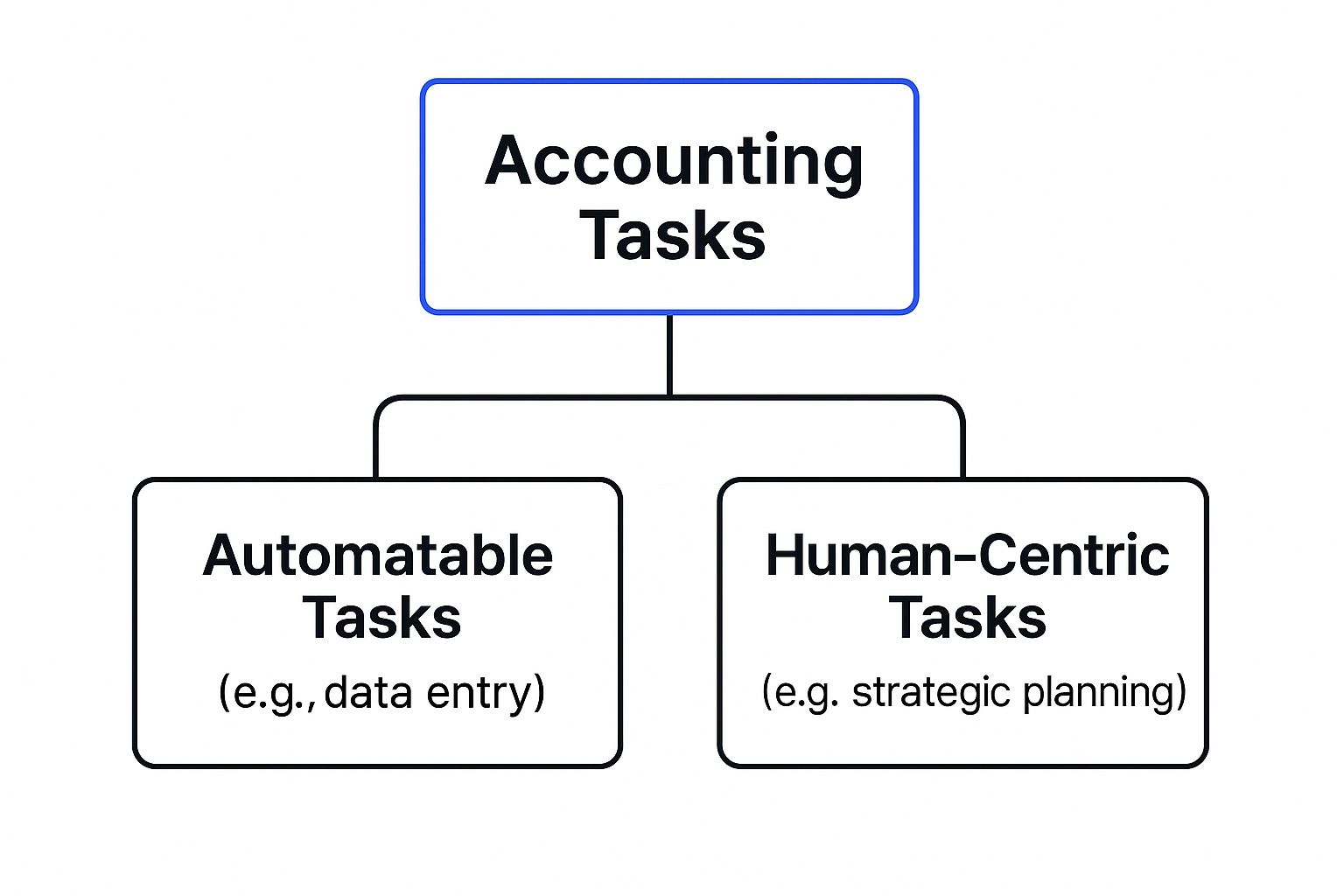

This image perfectly illustrates the new division of labor between what can be automated and what still needs a human touch.

As you can see, AI is perfectly suited to absorb the routine work, which in turn allows human expertise to shine in areas that demand real judgment and strategic thinking.

AI's Impact on Accounting Tasks Human vs Machine

To really get a feel for this shift, it helps to see a side-by-side comparison of where AI excels versus where human expertise is still king.

| Task Category | Tasks AI is Automating | Tasks Requiring Human Expertise |

|---|---|---|

| Data & Transactions | Automated data entry from invoices and receipts. Reconciling bank and credit card statements. Categorizing expenses based on predefined rules. | Handling complex or unusual transactions that defy standard rules. Interpreting ambiguous data. Verifying the context behind the numbers. |

| Reporting & Analysis | Generating standard financial reports (P&L, balance sheets). Identifying data anomalies and flagging outliers. Creating basic forecasts based on historical data. | Providing strategic advice based on financial reports. Explaining the "why" behind the numbers. Building complex, forward-looking financial models. |

| Compliance & Tax | Calculating standard tax liabilities. Flagging potential compliance issues based on set parameters. Preparing basic tax forms and filings. | Navigating complex tax laws and planning strategies. Representing clients during audits. Providing ethical guidance and professional judgment. |

| Client Interaction | Answering routine client queries with chatbots. Sending automated payment reminders and notifications. | Building client relationships and trust. Communicating complex financial concepts in simple terms. Understanding a client's unique business goals and challenges. |

This table makes it clear: AI handles the "what," while accountants are increasingly responsible for the "so what?" and "what's next?"

AI as a Powerful Assistant, Not a Replacement

The data backs this up. A recent Intuit QuickBooks survey found that a staggering 98% of US accountants used AI in their practice last year. While AI is poised to automate up to 30% of traditional accounting work, its main effect is relieving professionals from the daily grind.

This isn't a story about replacement. It's about augmentation, giving accountants the tools they need to elevate their focus to high-level financial advisory and client service. You can read a full analysis of AI's growing role in accounting to dig deeper into these trends.

How AI Is Being Used in Accounting Today

Forget the futuristic hypotheticals—AI is already a working part of accounting firms all over the world. Right now, its biggest impact is on automating the high-volume, repetitive tasks that used to eat up so much of an accountant's day. Think of it as the most efficient digital assistant you've ever had, one that handles the tedious groundwork with incredible speed and accuracy.

This isn't about replacing people; it's about freeing them up. Instead of a junior accountant manually keying in data from a mountain of invoices, AI-powered tools with optical character recognition (OCR) can scan, pull, and categorize that same information in a fraction of the time. This doesn't just save hours—it dramatically cuts down on human error, giving you cleaner data right from the start.

Automating Core Accounting Functions

The most visible changes are happening in the day-to-day grind. These AI tools are built to run in the background, tackling the essentials so that professionals can spend more time on high-level analysis and actually talking to their clients.

Here’s where you can see AI in action right now:

- Automated Data Entry: Modern systems can literally read invoices, receipts, and bank statements, then plug the data directly into the general ledger. No more manual entry.

- Invoice Processing: AI can manage the entire process, from matching invoices to purchase orders, flagging any weird discrepancies, and even routing them to the right person for approval.

- Bank Reconciliation: Remember spending hours ticking off transactions? Machine learning algorithms now do that in minutes, matching thousands of entries and only flagging the few exceptions that a human needs to look at.

You can see this shift in major accounting platforms. This screenshot from Intuit, for example, shows how AI is being built right into the user experience.

It’s not some hidden feature anymore. Generative AI assistants are front and center, actively helping users manage their finances.

Enhancing Financial Analysis and Fraud Detection

But AI is more than just a data-entry workhorse. Machine learning models are brilliant at finding the "needle in the haystack"— spotting subtle patterns in huge datasets that a person would almost certainly miss. This opens up massive opportunities for deeper analysis and better security.

For instance, an AI can comb through years of expense reports to pinpoint anomalies that might signal fraud. It can also sift through reams of market data to create much more accurate financial forecasts, giving businesses a clearer view of what's ahead. This is a big deal. It shifts the accountant’s role from someone who just records history to a strategist who helps shape the future. The real value is no longer just in preparing the numbers, but in interpreting what the AI finds and advising on the next move. For instance, to present cleaner data from these tools, an accountant might use a simple AI prompt to remove em dashes and en dashes from a generated report.

The payoff for this shift is already huge. Some research indicates that AI could cut operational costs for accounting firms by as much as 40%. That's a massive saving, driven almost entirely by reducing manual work. With more than half of all firms already bringing AI on board, the direction is undeniable.

These efficiency gains and cost savings are precisely why AI adoption is moving so fast. It's quickly becoming a standard part of the modern accountant's toolkit.

Where AI Falls Short and Humans Excel

For all its power, AI is still just a phenomenal calculator and data processor. It fundamentally lacks wisdom, intuition, and real-world context. It can tell you what the numbers are, but it can’t tell you why they matter or what you should do next. This is precisely where human accountants don't just survive—they thrive.

AI is brilliant at processing data, but people provide the critical judgment, empathy, and strategic insight that drive real value. You just can't program the nuanced skills needed for high-stakes financial decisions.

Navigating Complexity and Ambiguity

AI does its best work with clean, structured data and clear, predictable rules. But we all know the real world of business is messy. It's ambiguous and full of exceptions that don't fit neatly into a box.

Think about a unique, one-off business expense. An AI might misclassify it or just flag it as an error, creating more work and confusion. A seasoned accountant, however, can lean on their experience to understand the context, ask the right questions, and make a judgment call on how to handle it properly.

It's in these "gray areas" that human expertise becomes truly irreplaceable.

AI can analyze historical data to produce a forecast, but it takes a human to interpret that forecast in the context of shifting market dynamics, a new competitor, or a client's personal risk tolerance.

This ability to think critically beyond the raw data is a uniquely human strength. It’s what separates sterile information from genuine strategic advice.

The Irreplaceable Value of Human Connection

Perhaps the biggest gap AI can't cross is building relationships. Accounting has never been just about the numbers; it’s about building trust, communicating clearly, and providing reassurance during stressful financial moments.

Picture a small business owner staring down a potential audit or a crippling cash flow crisis. They don't just need a spreadsheet—they need a trusted advisor. Someone who can listen with empathy, break down complex issues into simple terms, and offer a calm, strategic perspective.

- Strategic Advising: AI can spit out reports all day long, but it can't sit across the table from a client, discuss their long-term ambitions, and help them craft a custom financial strategy.

- Ethical Judgment: When faced with a tricky ethical dilemma, an accountant relies on a professional and moral compass that an algorithm simply doesn't have.

- Creative Problem-Solving: AI is stuck inside the box of its programming. A human accountant can think on their feet and devise innovative solutions for unique business challenges that fall well outside standard procedures.

These so-called "soft skills" are now the most valuable tools in an accountant's kit. They are the bedrock of client relationships that an AI simply cannot replicate.

Understanding AI's Limitations

It’s also crucial to remember that AI models, particularly large language models (LLMs), can sometimes get things wrong. They can produce incorrect or completely fabricated information in a phenomenon often called "hallucinations." As powerful as these systems are, they don't truly "understand" financial concepts in the way a person does.

This is why human oversight isn't just a good idea—it's essential. For those interested in the technical nitty-gritty, you can learn more about how to reduce hallucinations in LLM outputs.

The core takeaway, however, is that a human must always be the final checkpoint for accuracy and context. The accountant's role is shifting from number-cruncher to that of a validator, strategist, and trusted guide.

2. Reshaping Accounting Jobs and Skillsets

The rise of AI isn’t just about adding another tool to the accountant's belt; it's completely redrawing the career map. The classic question, "Will AI replace accountants?" misses the point. It’s not about elimination, it’s about evolution. We're seeing a massive shift away from jobs built on repetitive data entry and toward roles that demand a smart mix of financial acumen and tech savvy.

This change means some traditional accounting jobs are, frankly, fading away. The routine clerical work that used to be the bread and butter of junior positions is now being done faster and with pinpoint accuracy by AI. But that's not where the story ends. For every task that gets automated, a new strategic door opens for professionals who are willing to adapt.

The Decline of Clerical Roles

This isn't just a theory. The World Economic Forum's Future of Jobs Report has singled out accounting, bookkeeping, and payroll clerks as one of the fastest-declining job categories out there. The main driver? AI and automation are simply better at the predictable, rules-based work these jobs depend on. You can get a deeper dive into this from Thomson Reuters' analysis of how AI is affecting accounting jobs.

While that might sound a bit grim, it’s really a reallocation of human talent. The industry isn’t shrinking; it's specializing. The demand isn’t vanishing; it's climbing up the value ladder to roles that need skills a machine just can't replicate.

The Rise of New Specializations

As AI handles the "what," companies are desperately looking for people who can explain the "why." This has thrown open the doors to exciting career paths that were pure science fiction a decade ago. These jobs are far less about crunching numbers and much more about interpretation, strategy, and oversight.

Here are a few of the fastest-growing specialties:

- Forensic Accounting: Sure, an AI can flag a weird transaction, but it takes a human expert to unravel a complex financial crime, connect the dots, and build a solid case.

- Data Analysis: Professionals who can dive into huge datasets, spot meaningful trends, and turn financial noise into clear business strategy are worth their weight in gold.

- AI Implementation Consulting: Businesses need people who understand both accounting and technology. These consultants help them choose the right AI tools, get them running, and manage them effectively.

The modern accountant isn't just a keeper of the books anymore. They're a strategic advisor, a data storyteller, and a tech-fluent problem-solver. The most valuable asset is no longer speed in calculation but depth in critical thinking.

This brings us to a crucial point: soft skills are the new hard skills. Creative problem-solving, clear communication, and the ability to earn a client's trust—these are the durable, irreplaceable qualities that will define the next wave of successful accountants. The future belongs to those who learn to work with AI, not against it.

The Shifting Skillset for Modern Accountants

The skills that defined a great accountant twenty years ago are not the same ones that will define one twenty years from now. As automation takes over the predictable work, the demand for uniquely human skills skyrockets. The table below shows just how much the focus is changing.

| Declining Skills (Automated by AI) | In-Demand Skills (Augmented by AI) |

|---|---|

| Manual Data Entry & Reconciliation | Strategic Business Advisory |

| Basic Bookkeeping & Payroll Processing | Advanced Data Analytics & Interpretation |

| Repetitive Compliance Checks | Critical Thinking & Complex Problem-Solving |

| Routine Financial Report Generation | Emotional Intelligence & Client Relations |

| Transaction Categorization | Tech Implementation & Systems Management |

| Calculation & Spreadsheet Management | Forensic Investigation & Fraud Detection |

What this table makes clear is that the future isn't about being a human calculator. It’s about leveraging the machine's calculations to provide deeper, more valuable insights than ever before. The accountant of tomorrow is an analyst, a strategist, and a trusted advisor, all rolled into one.

How to Future-Proof Your Accounting Career

The question "will AI replace accountants?" isn't a threat. It's an invitation to evolve. Instead of seeing automation as a competitor, the smartest pros are using it as a launchpad for growth.

Future-proofing your career isn't about learning to code. It's about shifting your focus away from tasks a machine can do and doubling down on the value only a human can bring. It's about becoming an essential strategic partner.

The first step is to lean into technology, not shy away from it. Get your hands on the AI-powered tools that are reshaping the industry. This means moving beyond your comfort zone in spreadsheets and getting familiar with modern accounting platforms and data visualization software like Tableau or Microsoft Power BI. When you understand how these systems operate, you can properly supervise their work, catch potential errors, and translate their output into smart business advice for your clients.

Develop Your Analytical and Advisory Skills

With AI crunching the numbers and handling the repetitive work, your real value is in interpretation. You need to become a data storyteller—the person who can look at a wall of numbers and see the story unfolding behind them. This is a move from simple compliance to true advisory.

Here’s how to start building that muscle:

- Deepen Your Industry Knowledge: Don't be a generalist. Specialize in a specific industry so you can understand its unique financial quirks, challenges, and opportunities.

- Master Financial Modeling: Stop just reporting on what happened last quarter. Build sophisticated, forward-looking forecasts that help your clients get ahead of problems and jump on opportunities.

- Sharpen Your Communication Skills: Practice breaking down complex financial topics into simple, clear language. Your job is to empower clients to make confident decisions, not to confuse them with jargon.

Think of yourself as a financial translator. The AI gives you the raw text (the data), but you provide the crucial context and meaning that makes it useful.

One of the biggest shifts we're seeing is the move from service provider to strategic advisor. Your ability to give nuanced, context-aware advice on everything from cash flow to long-term growth is a uniquely human skill that can't be automated.

Embrace Continuous Learning and Specialization

The days of learning one skillset and riding it out for an entire career are long gone. The most secure path forward is one of constant learning and adaptation. This doesn’t mean you have to go back to school for another degree. It can be as simple as getting certifications that meet new market demands.

Consider specializing in high-demand fields where human judgment is absolutely critical:

- Forensic Accounting: Uncovering financial fraud and discrepancies requires an intuition and investigative instinct that AI just doesn't have.

- ESG (Environmental, Social, and Governance) Reporting: This field is exploding, and it requires expertise in non-financial data and tricky regulatory guidelines.

- AI and Systems Integration: You could become the go-to expert who helps firms choose, set up, and manage their new AI accounting systems.

A huge part of this learning curve is figuring out how to work with AI. Learning to write effective instructions, or prompts, can make a massive difference in the quality of the reports and analyses you get back. You can explore the different https://promptaa.com/blog/types-of-prompting to see just how much precise language matters.

Ultimately, future-proofing your career isn’t about trying to out-work a machine. It's about partnering with it to offer a level of strategic insight that was never possible before, cementing your place as an irreplaceable advisor.

Answering Your Questions About AI in Accounting

It's only natural to have questions as artificial intelligence finds its footing in the accounting world. Let's break down some of the biggest concerns professionals have and get a clearer picture of what's really happening.

The conversation has moved past "Will AI replace us?" to "How can we work with AI?" It's a fundamental shift. Think of it as a new partnership where technology handles the grunt work, freeing up human experts to focus on the strategic, client-facing work that no machine can replicate.

Is AI Going to Take My Accounting Job?

The short answer is no, but it will definitely change it. AI is becoming an incredible assistant, one that's perfect for the tedious, repetitive tasks that eat up so much of an accountant's day—things like data entry, sorting transactions, and initial reconciliations.

By offloading that work, you get to concentrate on the high-value stuff that requires a human brain. We're talking about strategic financial planning, solving messy, complex problems, and building strong client relationships. These things demand critical thinking, creativity, and empathy, which are still firmly in the human domain.

While some purely clerical roles might fade away, new opportunities are popping up for professionals who can interpret the insights AI generates and use them to steer business strategy. The demand is shifting from number-crunching to expert consultation.

What Skills Should I Learn to Stay Relevant?

Your best bet is to build a hybrid skillset—one that merges solid tech know-how with your irreplaceable human abilities. On the technical side, getting comfortable with data analytics and understanding the AI features in modern accounting software is quickly becoming non-negotiable. You need to know how the tools work to manage them well.

But it’s the "soft skills" that are really becoming the key differentiator. These are the skills that set you apart:

- Critical Thinking: The ability to look at the data AI spits out, question its assumptions, and find the real story within the numbers.

- Strategic Communication: You have to translate complex financial data into plain English so your clients or stakeholders can make smart, confident decisions.

- Adaptability: This is huge. You have to be willing to constantly learn new tools and be flexible enough to change how you work as the technology gets better.

The most valuable accountants will be the ones who can be a translator between the technology and the business goals. They won't just hand over a report; they'll explain what it means, provide context, and offer the kind of advice that helps a business truly grow.

How Does AI Impact Small Business Accounting?

For small businesses, AI is a game-changer. It’s making sophisticated financial tools accessible and affordable in a way they never were before. Platforms like QuickBooks and Xero are baking AI right into their systems to automate bookkeeping, invoicing, and even payroll. This gives small business owners a much clearer, real-time view of their financial health.

This completely reshapes the accountant's role. Instead of getting bogged down in basic data entry and compliance work for their small business clients, their value shifts almost entirely to advisory.

The accountant becomes a strategic partner who helps the owner understand financial reports, plan for growth, and make smarter decisions backed by solid data. The question of will AI replace accountants is less about a threat and more about a massive opportunity. It means small businesses can now get the kind of high-level financial guidance that used to be reserved for big corporations.

Ready to master your AI interactions and get better results? Promptaa provides a powerful AI prompt library to help you create, manage, and enhance your prompts for any task. Organize your best prompts, learn from the community, and turn your ideas into precise instructions for superior AI outputs. Explore Promptaa today.